Banking and finance have undergone fundamental changes during and after the pandemic. More banks are boosting capitalization, expanding operations, but have fewer branches. This is mainly due to the rise of digital banking and the increasing acceptance of self-service tools by users.

Self service trend in Finance - Banking industry

Self-service banking, also known as self-service banking, is a system in which customers perform basic banking transactions without the assistance of a consultant. The most common self-service transactions include cardless withdrawals, digital banking, biometric authentication, bill payments, and other support services.

Most users today are satisfied with performing many financial transactions online through digital banking applications that are built with diverse features and intuitive design. With a large enough number of transactions, self-service banking will help both banks and customers save costs, increase operating time and improve work productivity.

According to the State Bank's report by the end of April 2021, Internet banking transactions increased by 65.9% in quantity and 31.2% in value over the same period. Transactions via smartphones increased by 86.3% and 123.1%, respectively. This index for transactions via QR Code was 95.7% and 181.5%. The above figures show that habits are changing. Users use digital technology more for "self-service" and self-experience of banking and financial services.

Application of IVR in Self service Banking

IVR or Interactive Voice Response is an automated system of interacting with customers over the phone. IVR is usually built based on flexible customizations for different purposes, the most common of which are:

- IVR for Call Center:

The system automatically divides phone lines into departments or hotline branches so that customers can quickly connect directly to the right line according to their needs. Based on this platform, banks can conveniently develop a variety of service scenarios such as: querying account information, checking balances, changing passwords, registering services, etc.

For example: When a user calls a bank, a pre-recorded voice message will automatically play. Then the customer is invited to press a key to reach the corresponding department, most commonly in the form of “Press 1 to check account balance, press 2 to change password…”.

Some of the most basic transactions that IVR supports include:

- Inquire about account balance

- Access account information

- Set PIN or change password

- Look up information (product price, category, etc.)

- Fill out forms and prospect surveys

- Small payments or money transfers

- IVR for marketing:

The system automatically calls a pre-determined customer group with a pre-designed scenario. If they agree to participate, customers can respond immediately via phone key. Based on this platform, banks can convey advertising messages, after-sales services or simply visit the right customer group in need.

For example: Automated voicemail to notify balance or support information from the bank to potential customers due to the impact of Covid-19.

- Smart IVR and Visual IVR – innovative solutions to enhance customer experience

After IVR was widely applied, its "upgraded versions" - Smart IVR and Visual IVR were born, bringing businesses more solutions to serve customers more comprehensively.

3.1. Smart IVR and Visual

Smart IVR is a new generation of intelligent IVR equipped with AI, open connectivity, and Text to speech to optimize the customer interaction process. While IVR allows callers to self-route to the right agent, Smart IVR can recognize the current customer's phone number to immediately transfer them to the most suitable agent.

With Smart IVR, banks can easily customize the features that best suit their call center, such as:

- Automatic voice recognition: opens up more Self Service options for users, for example customers can call the bank and use their voice as a password.

- CRM and Helpdesk Integration: Smart IVR takes CRM innovation one step further from one-way integration to two-way data exchange allowing technologies to interact intuitively together.

- Detailed reporting and predictive analytics: performance tracking, call flow optimization, and CSAT score improvement are all things that Smart IVRs can do. Some Smart IVRs can even predict what callers are looking for based on past integrated data.

- Secure payment processing: routing callers to the right agent is good, but Smart IVR is even better, helping customers resolve issues without having to meet an agent. In banking and insurance, secure payment processing over the phone is essential for businesses to survive thanks to IVR.

- Text-to-speech support: to provide text instructions to help callers resolve problems as quickly as possible.

3.2. Visual IVR

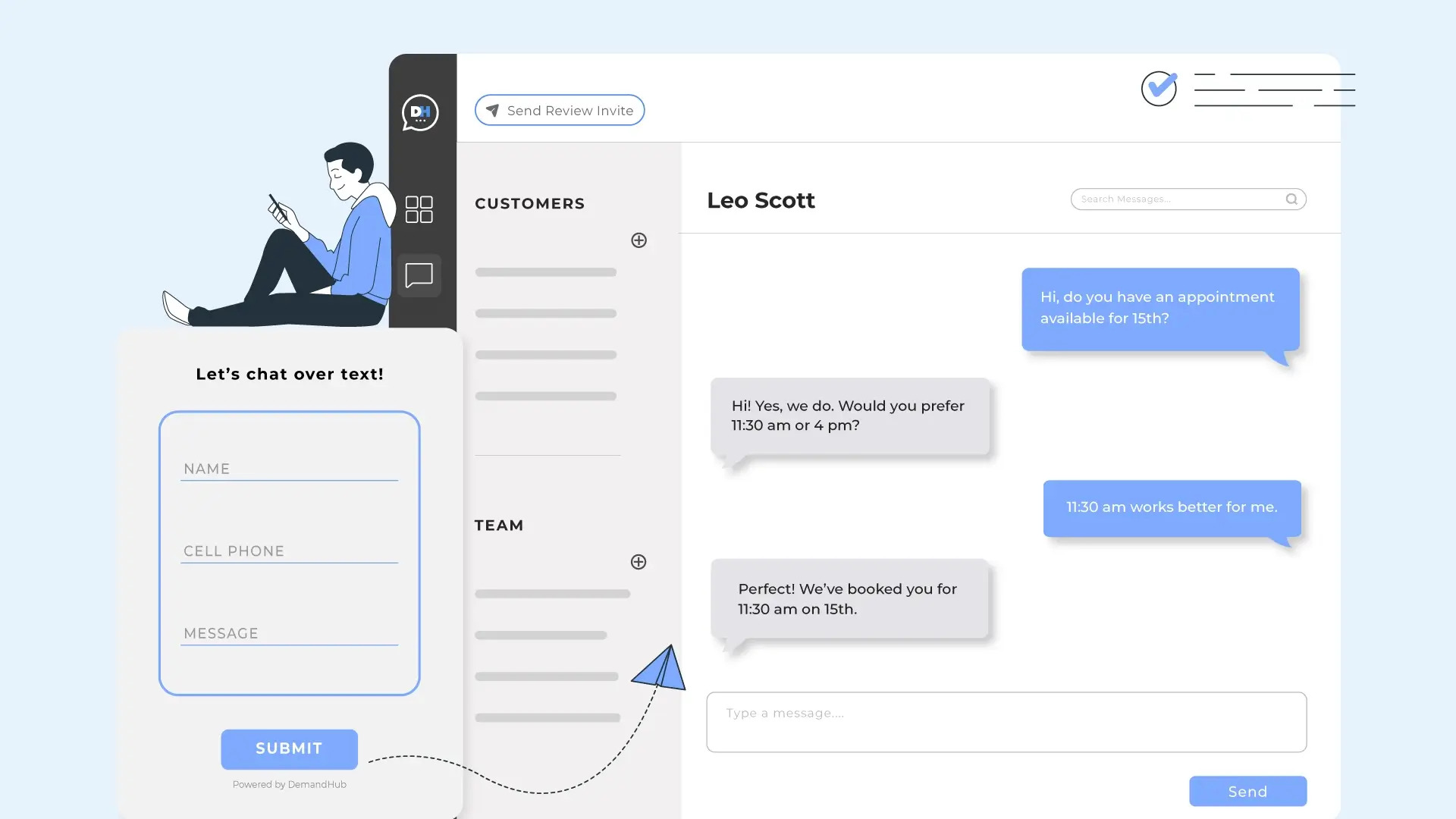

Visual IVR is a platform that uses web applications to direct self-service customers to the call center. Accordingly, a web link will be sent to the customer via email or text message without having to download or install any additional phone applications. From the intuitive web interface, customers can perform menu options, view account details, check balance fluctuations, deposit savings, pay bills or even register to buy a house or receive loan package advice.

Both traditional IVR and Visual IVR offer new ways to interact with customers to help them self-serve. However, a recent study by Sitel Group found that 70% customers are reluctant to talk to chatbots because they don’t trust the bot’s ability to accurately understand their needs. Visual IVR, in addition to increasing the efficiency of voice input, also provides customers with a comprehensive digital experience. It is as intuitive, easy to understand, and straight to the point as a mobile app, without the hassle of downloading or installing anything. In particular, almost anything that is already integrated into a website can be put into a voice channel and tracked in real time so that agents can call customers immediately.

With Visual IVR, businesses can enable customers to self-serve more of their real needs, quickly improving satisfaction and saving costs effectively. Banking users can quickly check balances or transaction history, insurance customers can inquire about the status of a claim, and retail customers will know when their orders are ready.

Benefits of IVR in Banking and Finance Industry

- Enhance customer experience

IVR Self Banking can quickly provide answers to frequently asked questions, helping customers save waiting time and avoid having to go directly to the transaction office to resolve problems.

- Enhance brand value in the minds of users

Customer satisfaction is directly proportional to the level of support provided by the bank. With immediate assistance at any time and place, users are sure to feel more secure and loyal to their financial institutions.

- Improve employee performance

IVR self banking can route all incoming calls, handle simple transactions, provide basic information and only send the teller to the overly complex transactions. This way, the teller can reduce the amount of unnecessary repetitive work, focusing on solving more complex problems at work.

- Available 24/7, reducing human error

Once set up, IVR can operate continuously 24/7, serving customers anytime, anywhere. The IVR's operating process is also set up logically from the beginning, so it minimizes errors caused by being "overwhelmed" by a large volume of calls or poor health like humans.

Not only possessing the most modern technology solutions supporting the digital transformation process and applying self-service technology, Bellsystem24 Vietnam is also a leading unit in tailoring Contact Center & BPO solutions for the Finance - Banking industry.