E-KYC Technology

- Shorten customer identification time

KYC (Know Your Customer) – Identifying customers. This is a mandatory process to verify the identity of customers when participating in the services of Finance, Banking and Insurance enterprises. e-KYC (electronic Know Your Customer) is electronic customer identification, or online customer identification, allowing businesses to identify customers 100% online.

The value of e-KYC

Fast, convenient

» Register to use services such as opening an account, bank card, etc. via mobile phone without having to wait in line at the counter. No space restrictions.

» Reduce customer authentication time to seconds instead of hours.

Transparent – Accurate

» Transparency in transactions, limiting fraud. Fast, objective customer authentication with very high accuracy (over 98%).

Catch up with the trend

» Digitizing document processing is a trend. E-KYC helps businesses keep up with the trend and supports enhancing customer experience.

Save

» Helps businesses save time, money and human resources compared to the traditional e-KYC model

Features

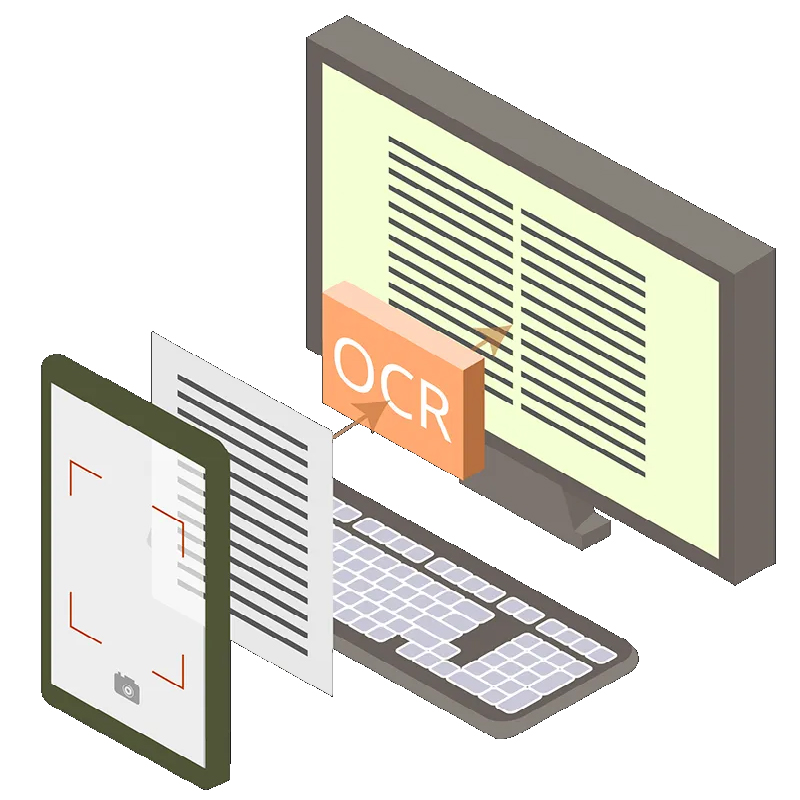

Optical Character Recognition

Using object detection model combined with optical character recognition to extract information on identity documents and deep learning model to compare and authenticate the face in ID card with real-life face.

Video Call

Using the modern, highly secure e-KYC Video Call model. Staff communicate and interact online with customers via video, instructing them on how to verify their identity (holding their ID card, moving their face, signing in front of the staff via video call, etc.)