LIVE Part 1, you have understood the need to change the cross-selling method if you want to better approach and convert customers in the digital age. Stay tuned for part 2 to learn how to apply the appropriate cross-selling solution! Cross-selling banking products needs to be a win-win relationship, something that both banks and customers find useful.

The Key to Cross-Selling Success in the Digital Age

Cross-selling is a required process (at least 2 steps).

Step 1, We need to use data and analyze data to have the most suitable offers for customers.Break down heavy barriers from channels, synchronize data. Be sensitive in predicting timing and needs, thereby "sticking close" and making "irresistible" offers.

Step 2, We need the right technology and systems to connect with customers at the right time and with the right needs. Every bank needs to have a 360-degree picture of the customer portrait: Including transaction history, their interaction history with customers, spending level, limit, outstanding debt, loans, GMV/spending value per time. Even collect additional necessary data about customers outside of transactions at the bank.

This customer's financial picture needs to be visible and updated across all channels, so that all functional departments can monitor and conduct in-depth analysis in the same place.

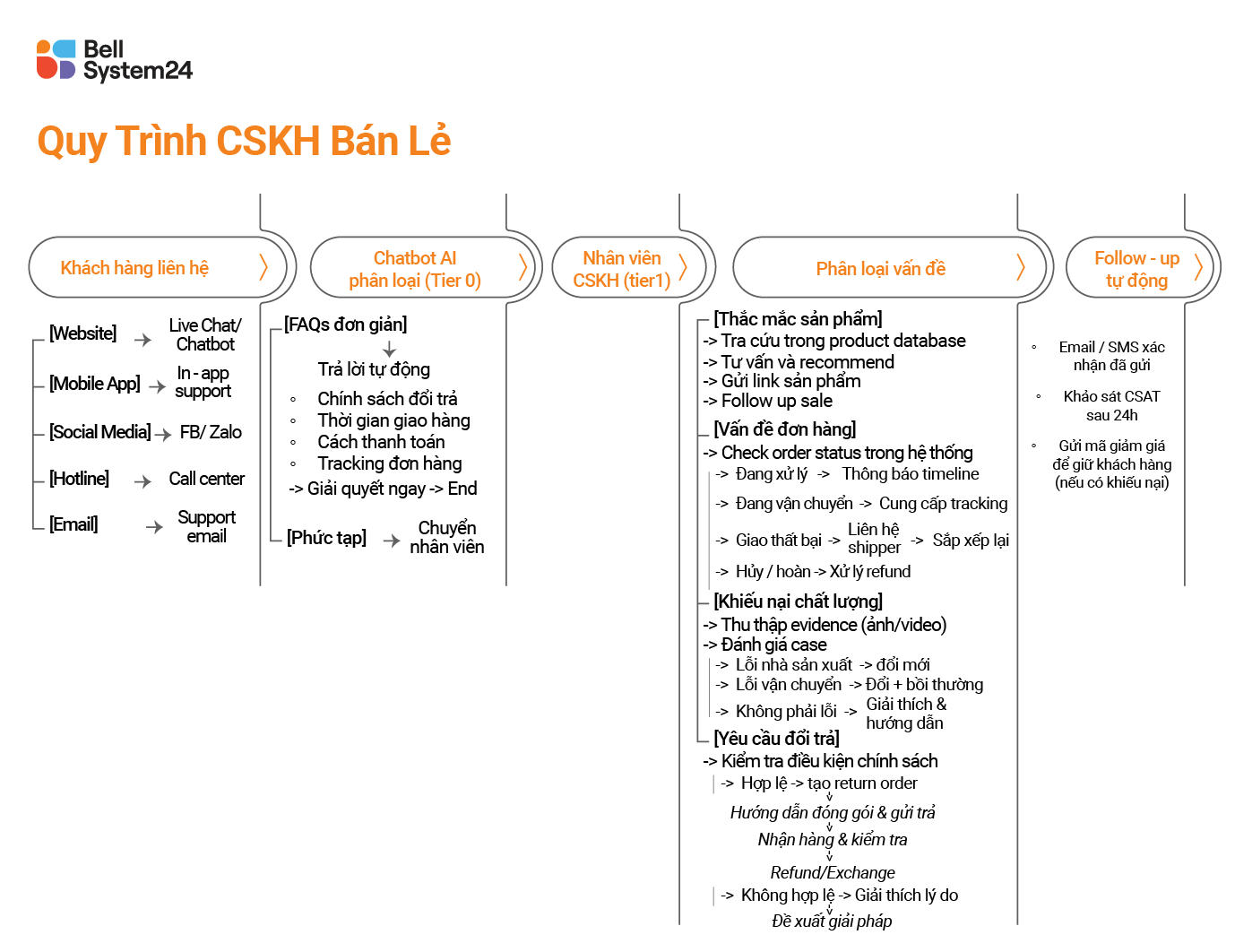

Effective cross-selling solution from Bellsystem24 Vietnam

- In-depth, quality system solutions

Tailored CRM system combines storage, synchronization, and accurate real-time customer data analysis

With this system, the Bank can:

- Tailored to the entire business process or dedicated to certain departments that do not have access to the core CRM due to security policies. This system can be used for data transfer/reporting from the core CRM (Customizable). There is a clear division of tasks and authority for each department and position/role in the bank. Ensure high security.

- Real-time interaction with customers on multiple channels (Social, Email, Hotline, Mobile app, ...) receives and updates real-time data. Supports the development of accurate real-time data from individual channels. Ensures multi-channel interaction with customers - an inevitable trend in the digital age.

- Have a diverse, complex, specialized reporting system according to the needs of each department and the entire bank. Analyze and sketch a 360-degree portrait of customers through all data sources (from partners, credit card team, Banca team, Priority team, available core CRM ...) Analyze available customer data from selling individual products and services to further identify potential customer needs. From there, create the most accurate customer approach and conversion scenario. Minimize duplicate calls to customers and lead to poor customer experience.

Deploy and maximize Contact Center performance

In fact, Contact Center is the channel that creates the most positive feelings for customers and brings the most revenue to banks.

Reference: Contact Center – The Key to Building Customer Experience for Banks

Besides the advantages of outsourcing, Bellsystem24 Vietnam's Contact Center solution brings a high difference because only we have a smooth combination of technology and in-depth perspective on human resources and operations.

For example, when implementing a project to sell credit cards and loans to an international bank, we have Business Intelligence Reports from extracting data from the bank's core CRM. Continuously analyze to have a 360-degree view of the customer. Then, during the implementation process, we propose a plan to promote Referral by capturing customer psychology through calls. Build a variety of communication scenarios to personalize the customer experience, bring good experiences to ask customers for good data for continued upselling, cross-selling. As a result, the bank's revenue from credit cards & loans has grown to 180%.

Continuously maintain multi-channel connection with customers, increase positive experiences and customer satisfaction with the brand through Omnichannel method

Whether cross-selling is successful or not depends largely on other customer experiences.

Bellsystem24 Vietnam supports providing valuable insights on customer experience so that banks can plan and design appropriate incentives. Next, it provides banks with ways to interweave effective cross-selling methods. This can be directly at the transaction counter, personal sales over the phone or indirectly through social media channels, email, etc.

Coordinate departments to create good customer experiences at every touchpoint to retain customers, contributing to creating loyal customers.

For example, bank customers will often be invited to try out and receive incentives when using other services and products of the bank. The brand also continuously launches product packages combining individual products including payment accounts, credit/debit cards, online services, along with attractive refund and free service policies for customers who buy and use them.

At the same time, the Bank will use the Omnichannel system of Bellsystem24 Vietnam to simultaneously maintain contact with existing customers through channels such as email marketing, personal sales via phone, etc. The information and messages automatically sent are personalized according to each person's needs, based on the information collected by customers. In addition, focus on training, building and operating good customer care policies. Almost all calls to the hotline are connected to the operator after a short waiting time (less than 1 minute). All of this creates a good, close and useful brand experience that makes them willing to use other products and services of the bank.

Deploy high performance, targeted Outbound Calls campaigns. Staff with excellent Upsell, Cross-sell skills

With experience in implementing hundreds of projects with outstanding results in Telesales/Telemarketing/Multi-channel sales for Banking - Finance partners over the past 16 years, Bellsystem24 Vietnam is proud to bring businesses the No. 1 quality Outbound Calls solution in the market, with:

- High performance automation technology feature system. Suitable for supporting banks in large campaigns.

- Training staff with excellent thinking and skills in Sales, Customer Care, Customer Experience, Handling difficult situations, having the courage and sensitivity when communicating with customers to recognize great upsell or cross-sell opportunities.

Not only promoting cross-selling to increase revenue, Bellsystem24 Vietnam also owns a diverse product and service ecosystem. Contact us now for effective business process outsourcing solutions in the digital age!