Customer satisfaction is a vital factor and a goal that all banks are currently pursuing. Accordingly, banks and financial institutions need to conduct focused research and analysis on customer satisfaction during transactions, thereby making recommendations to enhance operational efficiency.

One of the most objective and accurate evaluation methods is to use mystery shoppers. This is a common method worldwide, helping banks gain a more realistic view of service quality through the actual experiences of customers.

This assessment is also known as “mystery customer research” or “detective customer research” in banking.

What is mystery shopper research in banking?

Mystery shoppers are a service evaluation program in which trained individuals pose as real customers to experience services at branches. The purpose is to assess service quality, employee attitude, operational procedures, and key touchpoints that impact the customer experience.

The mystery shopper program will be evaluated according to specific criteria and the evaluation method will be tailored based on the bank's requirements, criteria and regulations combined with the fundamental elements of a standard customer service.

In the role of regular customers, the trained team (Mystery Shoppers) will observe factors that affect overall customer satisfaction in the transaction room.

This program helps banks:

- Identify strengths and weaknesses in customer service.

- Propose measures to improve service quality.

- Ensure consistency in the customer experience.

Key touchpoints of the bank's secret customers

Main touch points at the bank include: Tellers, Transaction point facilities, Security.

At each touch point, Mystery Shoppers will observe and secretly record the entire journey as well as evaluate other subjects if they appear on the Mystery Shoppers' journey.

Dealer

- Ready to serve

- Customer empathy

- Professional knowledge and skills create trust with customers

Facilities

- Facilities in the areas

- Green, clean, beautiful space

- Consistent images that match identity

Other Objects – Protection

- Ready to serve

- Proactive – interact well with colleagues

FREE DOWNLOAD NOW: Checklist to evaluate service quality and facilities at transaction offices – Professional Mystery Shopping Checklist

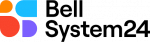

Implementation process for confidential banking clients and shared working solutions

Each normal bank will have different output targets, structures and processes, but in general, to evaluate the quality of a bank, we need to perform the following steps:

1. Design the scoring criteria table

- Build a scorecard based on bank assessment criteria

- Build a scoring table and weight the assessment items

- Building assessment scenarios

2. Recruitment and training

- Mystery shopper must pass tests such as: soft skills, post-training assessment, pre-employment assessment

3. Actual assessment

- Evaluation at each branch in different evaluation periods

- Record every day

- Recorded for review and quality control

4. Quality management

- Quality management team is independent of project implementation team

- Facility photography

- 100% recording secret client performance

- Group leader checks 100% recordings

- QC randomly checks 15 reviews

5. Transfer of results

- Images and audio recordings of transactions

- Preliminary report on excel after completing % sample assessment

- Final analysis report on powerpoint

How to create a survey questionnaire (and scoring rubric)

The information is recorded as evidence through video or audio recording and the results are presented through a survey questionnaire - built according to the bank's criteria and regulations combined with the fundamental elements of a standard customer service and the customer service perspective.

Survey questions are detailed with answer options or in the form of Pass - Fail answers to increase objectivity in process monitoring. In each process, customer opinions are added to increase the richness of information and authenticity of the report.

Requirements and conditions for selecting collaborators

Recruitment:

- Age appropriate for each field, transaction

- Have a wide range of experience in various industries and services, especially knowledgeable about banking related services

Train:

- Training in the use of covert equipment

- Standards on project information security principles

- Training on manners and posture to ensure naturalness when conducting surveys

- Trading Script Training

- Training on survey content

- Take the test

Retraining:

- Provide feedback and re-training in case the collaborator's performance is not satisfactory or does not meet the survey requirements.

- Re-train on scripts for subsequent surveys (ensure rotation of collaborators and use of appropriate scripts)

What should the output report of the bank's confidential client ensure?

Ensuring the quality of summary reports provides a comprehensive overview of the quality of services offered by the bank and the industry. A report from the bank's mystery shopper program must ensure:

Survey

- Correct and sufficient number of survey samples

- Real transaction rate 100%

- Clear evidence

Confidential – Objective

- Ensure confidentiality before – during – after the survey project

- Keep all survey data confidential

- Ensure objectivity and honesty in all project operations

Progress

- Ensure survey progress is on schedule

- Ensure timely grading

- Ensure reporting submission/response time according to both parties' plan

Detailed, reliable reporting

- Return detailed results from raw data (audio files, video files)

- In-depth analysis and assessment of existing issues

- Extract customer insights and accurate recommendations

4 criteria to ensure if you want good output results for detective customer service

Factors that make a successful bank mystery shopper program

- Professional Mystery Shopper Training to ensure professionalism.

- Strict inspection process to ensure quality accuracy of the data.

- Respond promptly and take action improvements from the bank.

- Using modern technology to collect data and analyze the results.

As one of the pioneers and leaders in Mystery Shopping services in Vietnam, with extensive experience in implementing mystery shopping programs for banks at many large financial institutions, BELLSYSTEM24 VIETNAM possesses in-depth expertise, professional processes, and a comprehensive, systematic quality assessment system that is second to none in the market. We have a variety of pricing methods for partners to choose from (Price per visit, total project price...)

Let us advise you!

- Hotline: 1900 1739

- E-mail: contact@bell24vietnam.vn