Solutions for Finance and Banking

Partners

Business challenges

In the era of the 4.0 revolution, Banking and Finance organizations not only have to focus on improving customer experience at every touchpoint, but also have to carry out digital transformation to adapt to the general trend. Some difficulties that Banking and Finance organizations are likely to encounter are:

- Large number of customers across multiple channels

- Difficulty in decentralizing access to the CRM system and allocating data to departments or partners for use, due to high data security requirements. Leading to a situation where data must be purchased indiscriminately, making it difficult to manage.

- Lack of a unified, comprehensive reporting system with clear decentralization for each team, channel, region, and general

- Lack of integrated multi-channel customer engagement and management solutions. Overlapping interactions, repeating the same needs with customers, leading to poor customer experience

Solution from Bell24VN

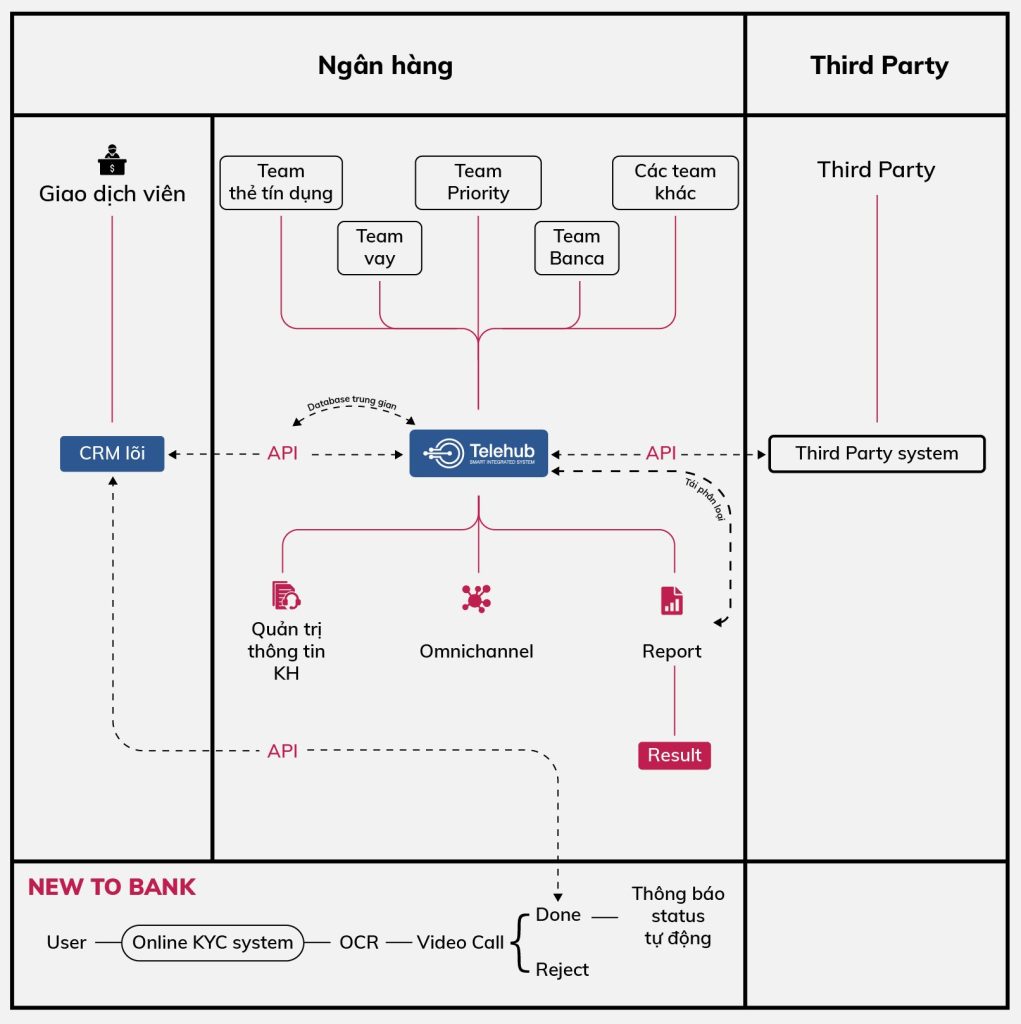

CRM system combined with tailor-made call center

Build a CRM that combines an integrated multi-channel switchboard, tailored to the entire business process or specifically for some departments that do not have access to the core CRM due to security policies. This system can be used to transfer/report data from the core CRM (Customizable). In addition, with the Omnichannel platform, along with automatic interactive modules, the system will help the Sales and Customer Service teams of the Banking and Finance enterprise significantly increase work efficiency.

Process optimization

- Departments share and use data together.

- Data is updated consistently across all departments (Customer journey management, knowing which employee has just interacted)

- Apply RPA to automatically perform pre-set tasks according to pre-defined criteria

- Comply with corporate security principles

Increase performance

- Manage and take care of customers according to schedule, automatically classify according to pre-defined criteria, then apply RPA to the customer care and sales process (Auto SMS, Happy call, Up-cross sale...)

- Automation features increase efficiency: Automatic call out based on scenario with Auto call IVR, Auto dialing, Chatbot

- Assign single lead to dedicated staff

Effective Management

- Saves a lot of time for managers in controlling, reporting, analyzing, etc.

- Detailed report, know employee productivity, productivity, SLA, Revenue. From there make decisions and calculate headcount.

Enhance the experience

- Integrated multi-channel interaction at all customer touch points (Call, Website, Social media, OTT, SMS, Mail..)

- Capture customer journey, reduce overlapping and repetitive interactions, thereby increasing experience

Call center operation solutions for the Banking and Finance industry

Outsource switchboard operation

Full-process call center operation solution before, during, and after sales for Banca, Credit Card, and Loan projects, helping to increase sales efficiency and create outstanding customer experiences.

USP

The solution covers pre-, during-, and post-sales processes. Including: lead generation, customer nurturing and interaction on an integrated multi-channel platform, Direct sales, KYC, Data analysis, customer care and maintaining post-sales interactions.

Use high quality data sources

RPA applications help maximize performance, reduce repetitive tasks, and optimize resources. Some typical technologies include: AutoDial, AutoCall, ACD, IVR

Scientific reporting system, tailored and API with other software, thereby helping managers easily get an overview of the business situation, on the other hand, it also helps save time and effort in making reports.

Use well-trained human resources. The staff not only have good communication, sales, and Up-Cross selling skills but also help create a great customer experience.

Get advice

Insource switchboard operation

High quality switchboard operation solution helps businesses

- Care, interact and answer customer questions to enhance experience at every touch point

- Collect information, classify and quickly direct customers to the right specialized department (such as service feedback, internet banking support, account opening, credit card service consulting, etc.)

- Proactively call customers to remind them to pay, pay fees, etc.

- Increase customer loyalty with regular customer care solutions, VIP customers

Minimize

42%

Attrition rate

Guaranteed to arrive

95%

SLA, Target, KPI

Switchboard Operator

24/7

Including holidays

ICT SLA up to

99%

system stability

Ensure

100%

Data Security

Growth

65%

Revenue

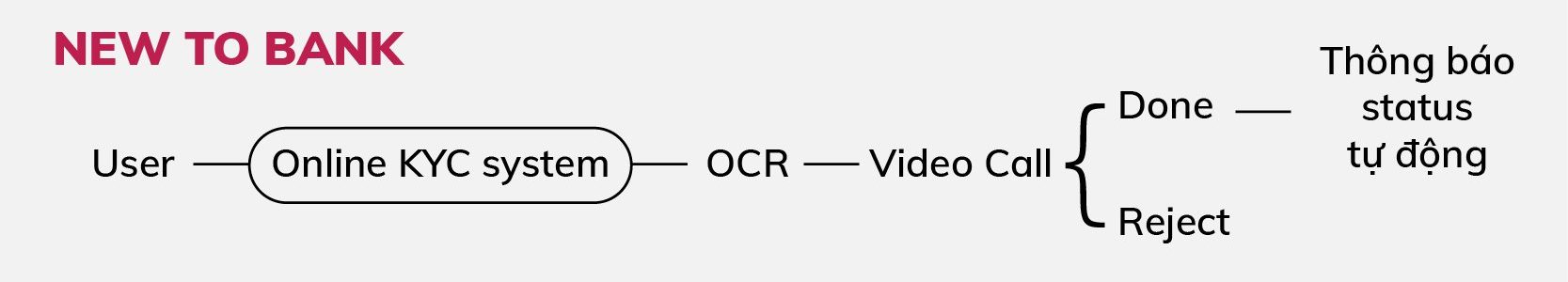

E-KYC solution via Video call

100% online customer identity verification solution by applying OCR (Optical Character Recognition) technology and verifying customers via video call, helps shorten verification time, save costs, assess and monitor risks, prevent illegal fraud. Thereby improving the efficiency of bank operations.

- Open a bank account

- Open credit card

- Open loan

- Buy insurance

- Other products and services

Triple S – Mystery Shopping Service for Banking and Finance Industry

This is a solution that helps businesses have an objective and accurate view of the quality of services, business processes, and quality of human resources that the business owns. Bell24 Vietnam does this by acting as a customer to experience and evaluate the business's contact points with customers from the perspective of a real customer. Mystery customer service can be deployed on multiple channels (Offline, Online, Call)

TRANSLATE with x English

TRANSLATE with

COPY THE URL BELOW

Back EMBED THE SNIPPET BELOW IN YOUR SITE

Enable collaborative features and customize widgets: Bing Webmaster PortalBack

- Experience and evaluate the quality of the transaction counter (Process, transaction staff, hygiene & transaction counter layout)

- Experience and evaluate online channels and call centers (Online customer care, call center staff, livebank experience)

Training solutions for Finance - Banking businesses

1

Advanced Skills Course

- Provide in-depth, quality training sessions for Sales and Customer Service staff, helping them improve their communication skills, customer service mindset and problem-solving abilities, helping to resolve and appease customers.

- Increase employee enthusiasm, love for their current job and trust in the business

Courses

2

LMS Finance – Banking System

- Online learning and training system is easy, scientific, intuitive, students can study anytime, anywhere.

- Digitizing corporate training programs

- Helps deploy synchronous training for branches, transaction counters, collaborators... without spending a lot of resources and costs.

- Fast application. Buy directly or rent the system and get free teaching content worth up to 36 million VND

About BSV

Why choose Bell24VN?

- Deep understanding of Finance - Banking industry

- Comprehensive solution, closely following business processes

- High flexibility at any time

- The most optimal cost

- No. 1 operating experience in Vietnam with more than 200 projects

Contact now

0

%

First Call Resolution

0

%

CSAT

0

%

Cost savings

0

%

Revenue growth

Case Studies

Some solutions that BELLSYSTEM24 VIETNAM has successfully deployed for partners in the Banking and Finance industry

Breakthrough in sales of international bank credit cards