What is Customer Churn Rate?

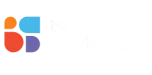

Customer Churn Rate (CCR): The customer churn rate is an important metric that reflects the number of customers who stop using a company's products or services within a certain period of time.

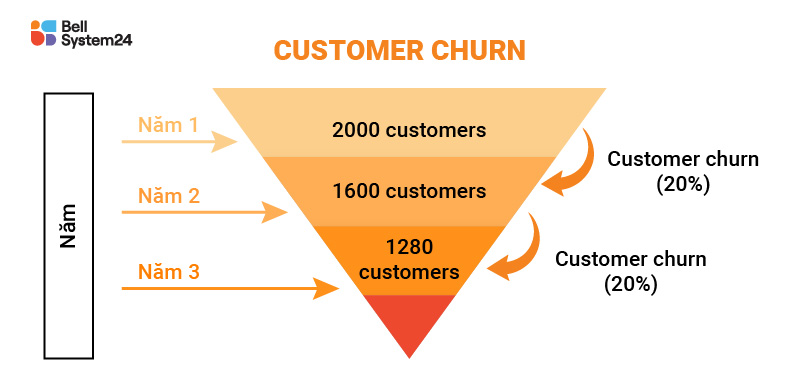

CCR calculation formula

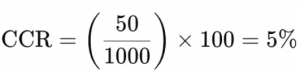

Example: You have 1,000 customers at the beginning of the month, but by the end of the month, 50 of those customers have stopped using your service. The churn rate is then calculated using the formula:

If a business does not effectively manage its Customer Churn Rate (CCR), all efforts to attract new customers may be in vain when existing customers leave too quickly.

What is a good customer churn rate?

The lower, the better!

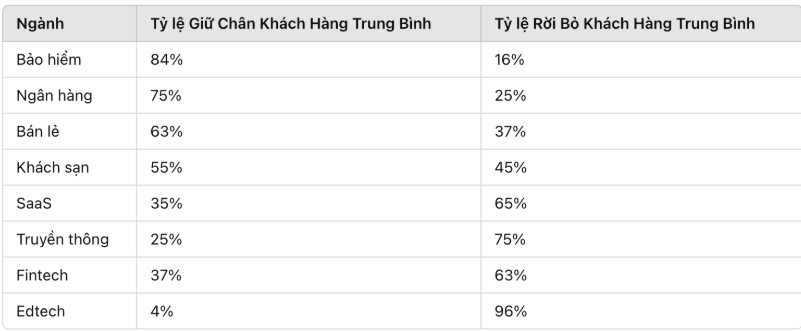

Whether a churn rate is considered "good" or "bad" depends on the standards of each industry. For example, in the insurance sector, a churn rate of 16% is considered normal, but in the SaaS industry, the churn rate is higher due to the competitive nature and specific characteristics of the market.

Below is a table showing the average CCR for several industries (calculated annually).

The importance of customer churn rate

a. Direct Impact on Revenue & Profit

Customer churn means that businesses lose revenue from them. If they cannot attract enough new customers to compensate, revenue will decline. In addition, the cost of attracting a new customer (Customer Acquisition Cost – CAC) is often much higher than the cost of retaining existing customers.

A study from Harvard Business Review shows that the cost of attracting a new customer is 5 to 25 times higher than retaining an existing customer.

b. Reflecting product and service quality

A high CCR may indicate that the product/service is not meeting customer expectations. This helps businesses quickly identify potential issues such as pricing, service quality, or poor customer experience so that timely corrective measures can be taken.

CCR reflects customer satisfaction level For the brand. A high churn rate may stem from poor customer service, fierce competition, or a lack of effective retention policies.

c. Customer Retention Strategy Support

Regularly monitoring CCR helps businesses optimize their customer retention strategy by:

- Improve customer support services.

- Enhance loyalty programs and customer care initiatives.

- Adjust products/services to better suit market demand.

d. Helping Businesses Make Accurate Forecasts

CCR data can be used to predict future customer churn trends, helping businesses adjust their financial plans, marketing strategies, and product development more effectively.

Customer churn classification

Not all CCRs are the same; identifying and taking the right approach will help optimize customer retention rates. Below are the common classifications.

1. Voluntary Churn

This is a case where the customer decides to leave the service or stop purchasing the product. The reasons may include:

- The price is too high compared to the value received.

- The product/service does not meet expectations.

- Poor customer experience, encountered many problems during use.

- Competitors offer more attractive solutions.

✅ Mitigation: Improve service quality, listen to customer feedback, and offer incentives or added value to retain them.

2. Involuntary Churn

Customers leave not intentionally, but due to objective factors such as:

- Payment error (card expired, transaction failed).

- Interruptions during use (forgetting to renew the package, loss of access).

- Changes in personal circumstances (moving house, changing jobs).

✅ Mitigation: Create a payment reminder system, allow automatic renewal options, and provide multiple payment methods.

3. Revenue Churn

Customers don't always leave completely. Some customers continue using the service but reduce their spending, which affects revenue. This happens when:

- Customers downgrade from a higher package to a lower one.

- Reduce the frequency of service usage.

- Reduce the number of orders.

✅ Mitigation: Offer attractive upgrade packages and maintain interaction to increase customer loyalty.

4. Deliberate Churn

Customers who plan to abandon a brand in advance, often for specific reasons such as:

- Complete usage requirements (e.g., register for short-term courses, complete projects).

- Switch to another provider for better long-term benefits.

- Loss of trust in the brand.

✅ Mitigation: Develop a customer retention program, provide added value to encourage continued use.

5. Accidental Churn

Sometimes customers leave simply because they forget or don't realize they're losing access. This happens when:

- The trial period expired without notification.

- Did not receive renewal reminders or return promotions.

- There are no changes in pricing or service policies.

✅ Mitigation: Send timely reminder emails/messages, create a simple reactivation process, and maintain interaction even when customers have not used the service for a period of time.

6. Competitive Churn

Customers leave because they are attracted by competitors. This is common when the market offers many alternatives and businesses fail to maintain their competitive advantage.

✅ Mitigation: Closely monitor the opponent's actions. make a difference in the customer experience, provide better service rather than just competing on price.

7. Relational Churn (Churn Due to Poor Relationship with the Brand)

Customers leave not because the product is bad, but because they feel neglected or the customer service is inadequate.

✅ Mitigation: Improve customer service, personalize the experience, build strong relationships with customers.

How to Reduce Customer Churn by Customer Segment

To develop an adjustment plan, businesses should understand that reducing Customer Churn Rate cannot be achieved by applying a single strategy to all customers. Therefore, understanding each customer group and applying appropriate methods helps businesses retain them more effectively.

See also: Empathy Map Guide – A Tool for Understanding Customers to Optimize Their Experience