Why is NPS/CSAT important in the digital banking race?

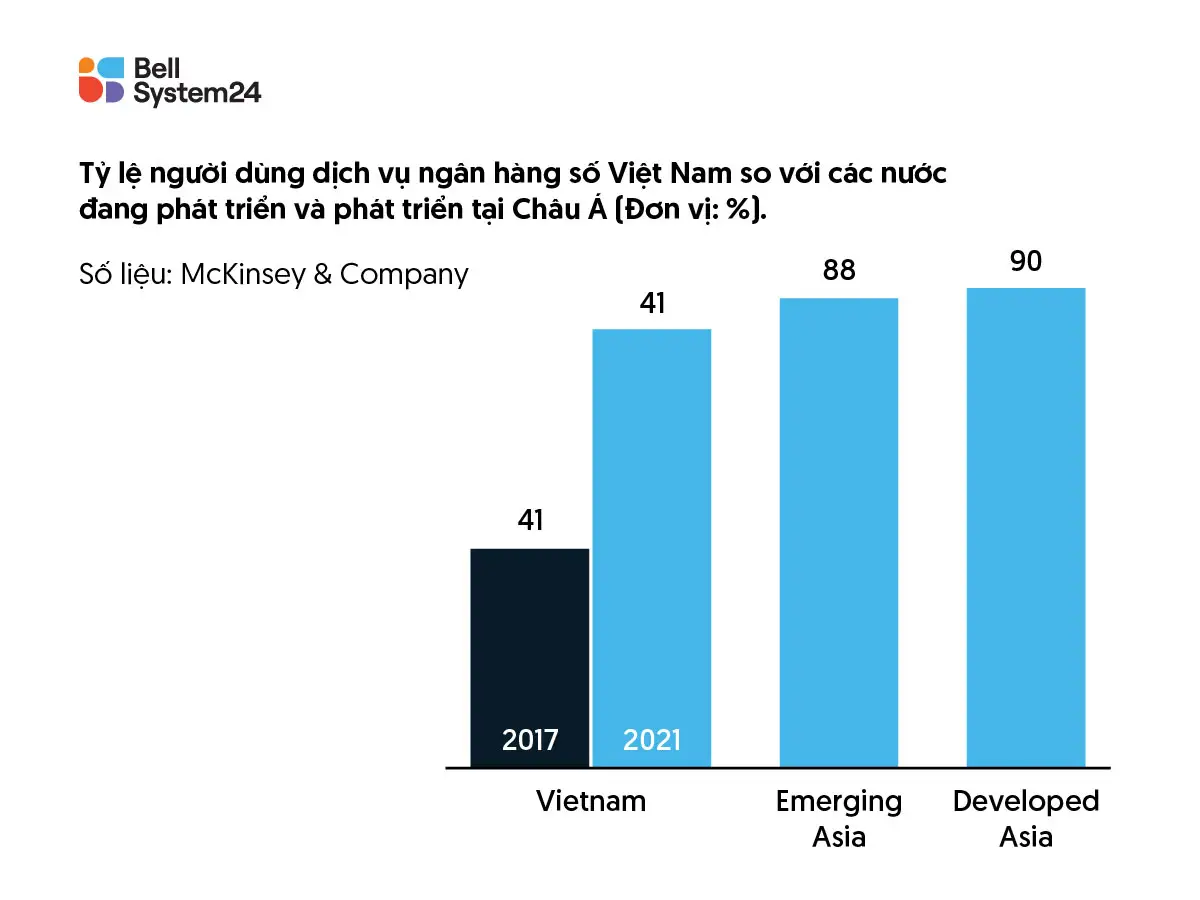

Banking is identified as one of the eight sectors that need to prioritize digital transformation. Vietnam's rate of digital adaptation and transformation is quite fast. According to research by Personal Finance Monitor, the rate of using e-banking applications in Vietnam tripled in 4 years from 22% in 2017 to 68% in 2021.

Most banks invest heavily in communication and promotion of easy account registration and attractive incentives when using the service. This leads to a high rate of cross-ownership of bank accounts by customers. For example, a subject can open a consumer account at bank A but deposit savings at bank B.

To survive in the fierce digital race now and in the future, banks need to continuously maintain and improve customer loyalty, reduce churn rate (the rate of customers leaving/stopping using the service). And NPS and CSAT are two of the most important, effective, and easily applicable indicators for banks to control and measure customer loyalty and churn rate.

Learn more about:

NPS (Net Promoter Score): https://bell24vietnam.vn/cx-ex-loyalty/kien-thuc-ve-nps-va-cach-do-luong-danh-gia/

CSAT (Customer Satisfaction Score): https://bell24vietnam.vn/cx-ex-loyalty/tinh-csat/

How to Measure NPS/CSAT in Banking

To measure NPS/CSAT, it is necessary to first identify the channels to be measured throughout the service journey, the user's touch points with the Bank's services. Some touch points include: Transaction offices, ATMs, Live Banking, Mobile Banking, Contact Center, Email, Website, Social media, Online ads, Print ads, Trade Centers, payment points using POS, e-commerce/online shopping sites, etc.

The key when implementing Net Promoter Score (NPS) and CSAT (Customer satisfaction score) measurement programs is:

- Choose the customer segment to measure, choose the customer touchpoints on the experience journey

- Know the factors that really impact the experience of that customer segment. Set up a concise but accurate and meaningful questionnaire/survey that is closely aligned with the needs.

- Conduct surveys in a professional manner, ensuring the bank's brand image. Implement a combination of other activities to create a seamless customer experience.

- Combine other activities to increase the number of Promoters, minimize the number of Detractors.

- Combine and apply NPS and CSAT results to other business goals.

You may be interested in: Contact Center – The key to enhancing customer banking experience

Case Study: Measuring NPS/CSAT of customers applying for credit cards

Bellsystem24 Vietnam is a long-term partner of Bank C, providing specialized Contact Center solutions to help Bank C optimize operational processes and increase revenue from improving customer experience.

Specifically, in addition to providing Contact Center system solutions with a team of professional, enthusiastic, and skilled staff in customer care, telesales & telemarketing to increase credit card sales for banks, Bellsystem24 Vietnam also implements regular and effective NPS and CSAT measurement activities.

After a period of interaction with the agent's own services, customers will feel ready to introduce and share information with relatives/friends/colleagues to experience Bank C's credit card service.

With 16 years of in-depth experience, Bellsystem24 Vietnam is confident in providing each business with flexible, effective, high-quality and optimal customer experience enhancement solutions.

You may be interested in: