Highlights

- Robotic process automation (RPA) can help insurance companies improve their claims processing, underwriting, and customer identity verification processes.

- RPA Helps reduce the paperwork workload of agents in the contact center by 80%.

- By leveraging RPA, agents can identify customer pain points and improve customer service accordingly.

The insurance industry is facing an exciting technological turning point. A recent study by McKinsey&Company shows that 80% of insurance companies recognize the need for digital transformation. However, 99.61% of the companies surveyed find it difficult to implement this transformation process. The rapid rise of 'InsurTech' companies (a term combining "Insurance" and "Technology") further increases the challenges that insurance companies face.

While disruptive trends such as Artificial Intelligence (AI) and advanced analytics are redefining risk assessment and policy underwriting in the insurance industry, business models are also undergoing fundamental changes. For example, Lemonade—a New York-based company providing insurance for renters and homeowners—has developed an AI-powered application. Specifically, programmed algorithms help underwriters provide quotes to customers. The entire registration and insurance enrollment process takes only 90 seconds. Submitting a claim is also very simple, with basic procedures processed and paid within just 3 minutes.

Recognizing the importance of customers in the digitalization process, insurance companies must invest in digital technology and automation. It is estimated that implementing robotic process automation (RPA) in operations can reduce total costs by up to 30%. Similarly, implementing RPA across all Contact Center functions can "elevate" customer service processes, improving efficiency and saving costs.

How RPA works

Nowadays, customers tend to prefer personalized services over online services. Contact centers can address this issue by implementing fast, simple, consistent, and error-free technology, available 24/7. Insurance users in North America consider problem resolution speed to be one of the most important requirements throughout the customer experience. For insurance companies, this needs to be achieved in order to reduce contact center operating costs, thereby gaining additional competitive advantages.

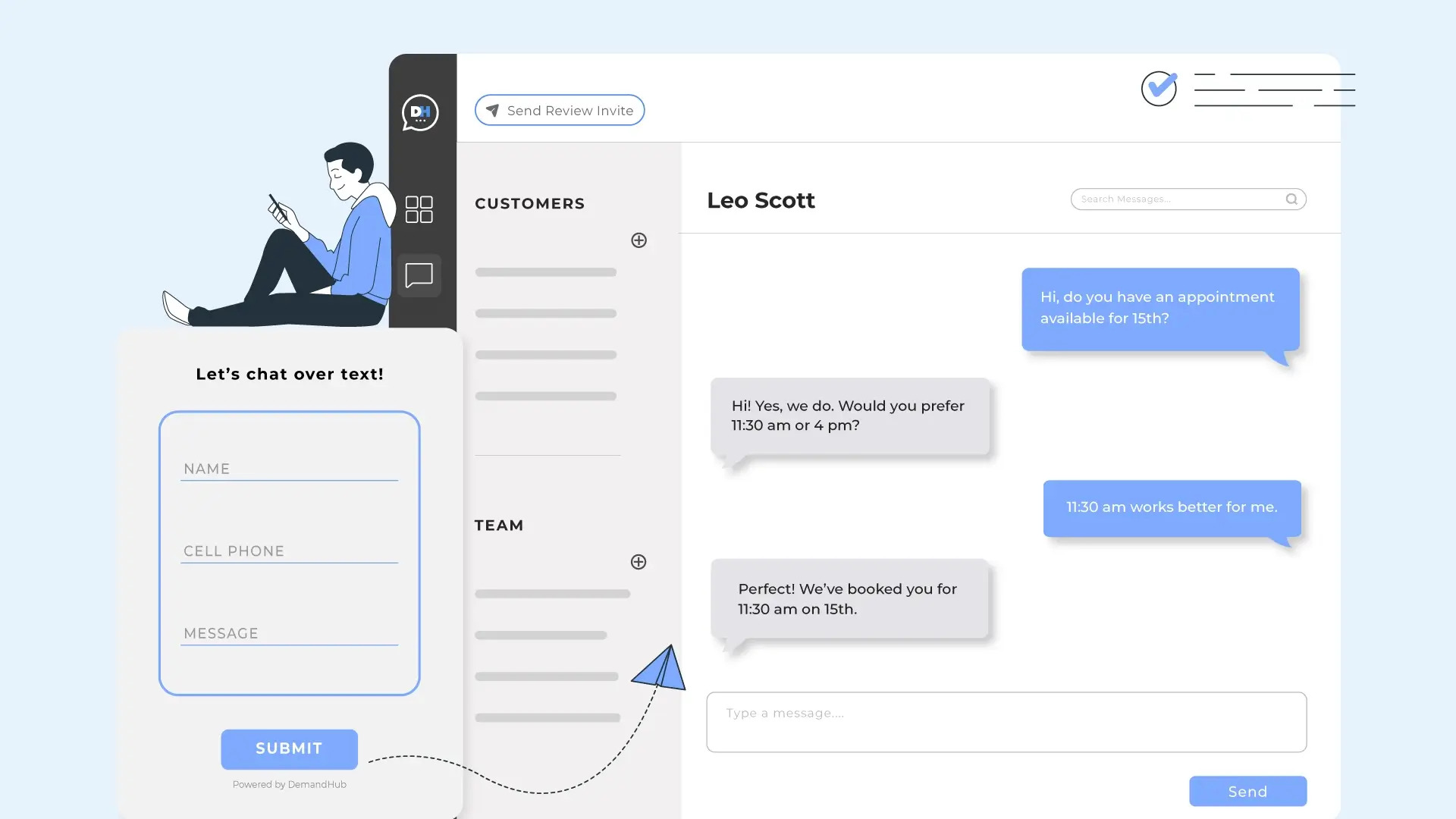

RPA can certainly provide these features. It can automate repetitive transactions in quoting, issuing, underwriting, policy management, and claims processing. At this point, the robot will act as virtual agents to collect data from systems and applications. Process transactions, respond to, and communicate with customers through digital channels quickly, consistently, and efficiently.

RPA integrates easily with existing systems, and it also has high scalability and promotes faster deployment cycles. Governance mechanisms can be automatically integrated for remote and centralized monitoring. RPA can be reasonably developed to handle natural language processing (NLP) and deep learning to extract relevant information from unstructured data sources such as images and handwritten forms. Most importantly, it can identify, manage, and build data repositories from points of dissatisfaction in the user experience. Thousands of daily user interactions will go through contact centers to find valuable insights, thereby improving the customer experience.

RPA can also enable contact centers to collect customer information from all different channels to develop unified and seamless customer service. For example, automation allows a UK-based insurance company to identify customers affected by flooding and design exemption programs for them.

You may be interested in: Bespoke CRM software tailored to business processes

Additionally, automation enables contact center agents to perform high-skill activities instead of repetitive, tedious tasks. Insurance agents typically spend 30% to 40% of their time simply recording transaction information. Meanwhile, RPA optimizes up to 80% of these tasks.

The main applications of RPA

1. Customer identification and verification

Customer information for insurance companies is often provided through multiple channels. Background checks, identity verification, financial fraud checks, and anti-money laundering measures typically require data to be imported or exported from various internal and external systems. Repetitive manual tasks can be tedious and prone to errors. RPA can be deployed in a rule-based workflow to push and pull information from multiple systems. The application of machine learning and AI technology will help deliver accurate and highly efficient results, while significantly enhancing the customer experience.

2. Register to confirm ownership

Implementing RPA can minimize human intervention in the insurance registration process. Robots can receive ownership verification requests from an automated request, verify customer details against content from the internal system, notify customers of the number of ownership verification requests, and forward requests to the corresponding investigation teams. This not only enhances customer satisfaction but also saves time, effort, and money.

3. Handling complaints

When a First Notice of Loss (FNOL) is received, contact center agents must access the systems to create a claim. Various procedures must be consulted and used to assess and review claims as well as prevent claim fraud. RPA systems can automate workflows to process requests faster and significantly reduce potential errors.

4. Multi-channel management

Today, many business processes revolve around an insurance company's policy system. Customers can enroll in policies through multiple channels, and most policy management systems cannot efficiently extract and consolidate data from different sources. Most companies must use manual processes to comprehensively capture customer information.

RPA can extract information from all channels and integrate it into the policy management system. The seamless combination of human agents and robots can be designed to quickly enact new policies and resolve policy verification issues.

5. Underwriting

RPA can quickly and accurately assess the risk of potential customers by mapping their information database with established rules to effectively underwrite issuance. Embedding AI-based algorithms and machine-learning techniques can provide a more detailed assessment than a simple rule-based workflow.

6. Handling back-office processes

RPA technology can significantly improve productivity in key office processes such as updating customer data, adjusting accounts, verifying checks, and protecting overdrafts.

7. Upselling and Cross-selling

Robots can perform comprehensive and accurate product and service searches during the sales process, extract detailed customer information from multiple applications, and consolidate it for agents to perform upselling and cross-selling. RPA can also complete post-sales documentation and notify customers of all relevant product details. So what are the results? Clearly, both sales and customer loyalty can increase significantly.

Case study: Superior Effectiveness When Selling Insurance Using Technology

8. Governance, Risk Management, and Compliance (GRC)

RPA, combined with machine learning, can keep pace with governance requirements. This ensures that insurance companies continuously comply and mitigate risks in the areas of data integrity, AML, fraud detection, and risk reporting.

Conclusion

The combination of RPA and humans can be considered a form of symbiosis. RPA provides contact center employees with detailed information to enhance the customer experience. It also helps agents use their skills and creativity to improve customer service, rather than doing paperwork. On the other hand, humans show robots the complexity of emotions through machine learning.

Therefore, the act of operate a contact center should be designed by combining automated solutions (RPA) and manual support for particularly complex issues. By mapping the end-to-end value chain, tasks can be identified for automation and customer service operational processes can be redesigned.

Here, RPA becomes a digital contact center agent tasked with seamlessly navigating business processes.